Bitcoin CBDC Pilot in Vietnam: HIBT’s Impact on Rural Payments

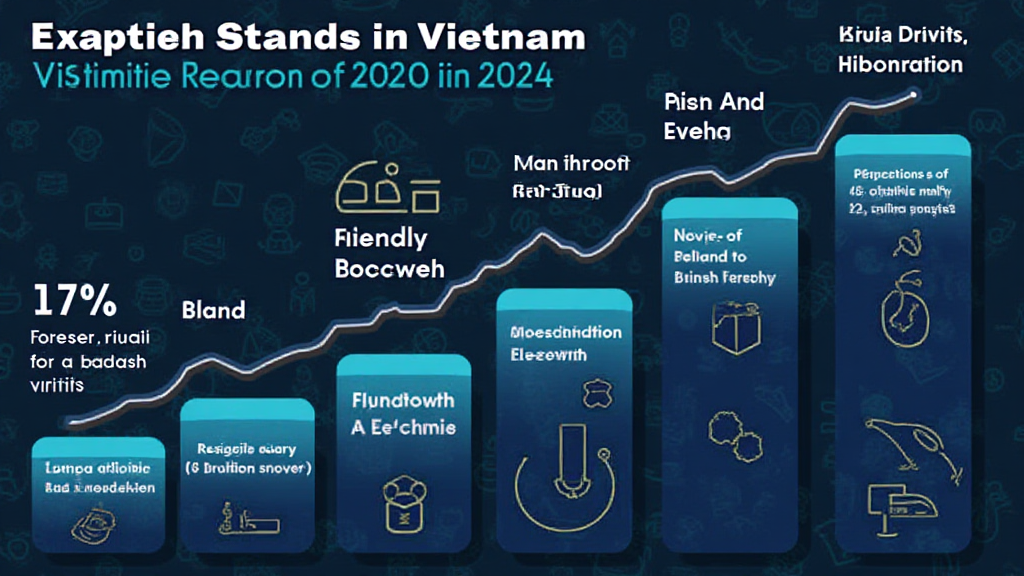

In recent developments, Vietnam has been piloting a Bitcoin Central Bank Digital Currency (CBDC) program, aiming to enhance financial inclusion across its rural regions. With a substantial percentage of the population still operating outside the formal banking system, this initiative could transform the landscape of rural payments. As per recent statistics, approximately 69% of Vietnamese adults were unbanked in 2021, highlighting a critical need for accessible financial solutions.

Understanding the Bitcoin CBDC Pilot Program

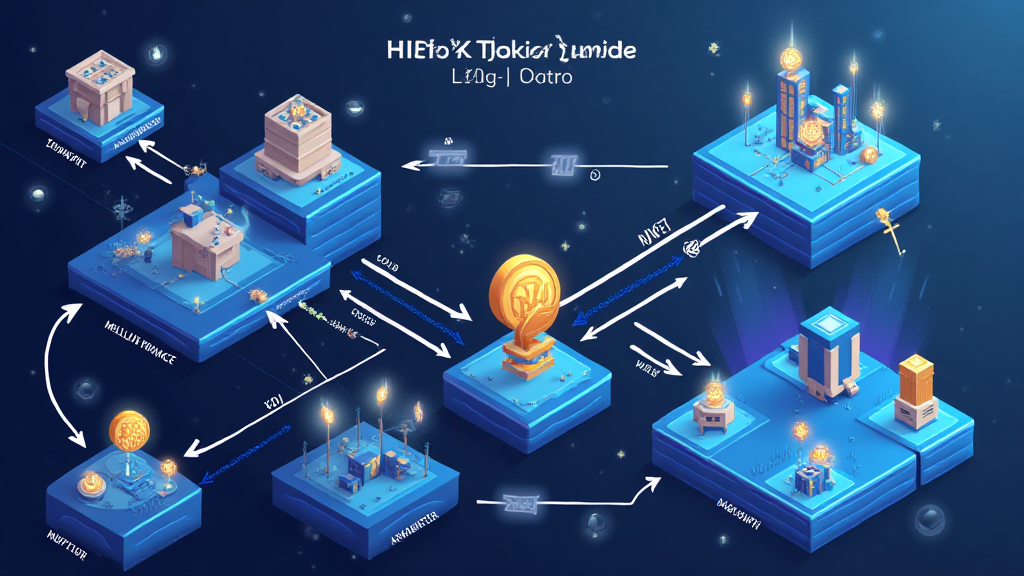

The pilot program seeks to explore the efficacy of integrating Bitcoin technology with a digital currency framework set by the central bank. This dual strategy not only ensures compliance with national policies but also leverages the technological benefits of blockchain, specifically the tiêu chuẩn an ninh blockchain (Blockchain Security Standards).

Why a CBDC?

Central Bank Digital Currencies have gained traction globally, especially as traditional banking systems face challenges such as security risks and operational inefficiencies. Vietnam’s approach symbolizes a proactive attempt to address these issues while also fostering a cashless economy.

The HIBT Initiative and Its Implications

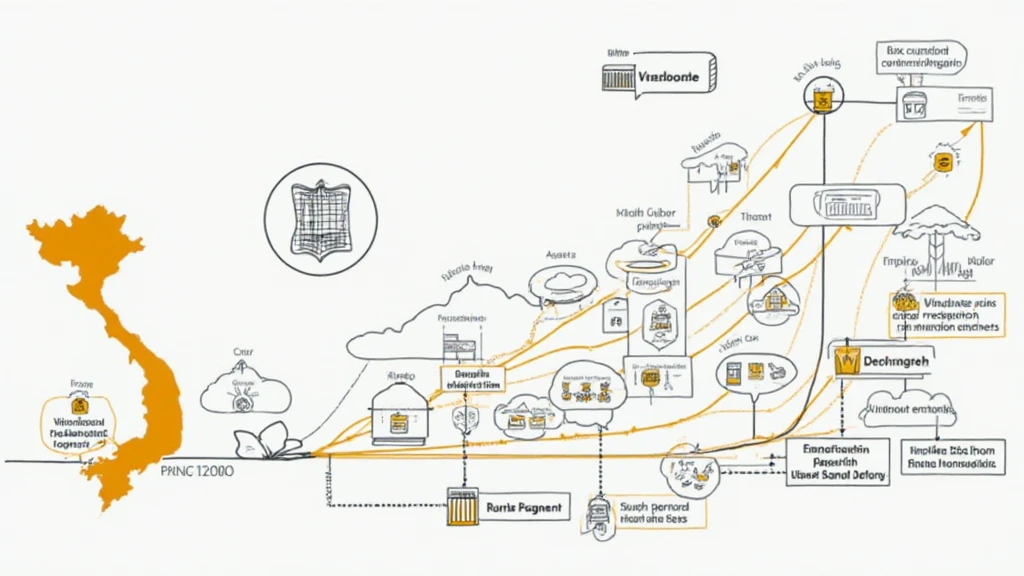

The HIBT (Hanoi Innovations in Blockchain Technology) initiative is crucial to this pilot program. It aims to bridge the gap between traditional payment systems and digital currency adoption in rural areas. By conducting extensive field tests, HIBT assesses the real-world applicability of Bitcoin CBDCs in various local settings.

Real-World Applications in Rural Payments

- Transaction Speed: Transactions under the pilot can be completed in seconds, a remarkable contrast to traditional methods that may take days.

- Cost Efficiency: Reducing transaction fees opens up financial services to lower income brackets.

- Reduced Barriers: Mobile wallets linked to the CBDC promote wider participation, especially among farmers and vendors.

Quantifying HIBT’s Impact

To evaluate HIBT’s success, monitoring key performance indicators (KPIs) will be instrumental. These include metrics like user adoption rates, transaction volumes, and overall impact on local economies.

Potential Economic Growth

According to recent data from the World Bank, 50% of Vietnam’s population lives in rural areas, often hampered by limited banking options. By providing a seamless payment alternative through Bitcoin CBDCs, local businesses could see a surge in economic activities. Increases in transaction volumes can directly correlate to local GDP growth.

Challenges Ahead

Despite the promising outlook, several challenges linger. Issues like cybersecurity risks, regulatory alignment, and potential backlash from traditional banking sectors need addressing. Engaging local stakeholders and community leaders will be key in overcoming these hurdles.

Policy Considerations and Regulatory Compliance

Establishing a robust regulatory framework is essential to ensure secure and compliant CBDC transactions. Vietnam’s central bank will need to collaborate with relevant authorities to set forth tiêu chuẩn an ninh blockchain that aligns with international practices.

The Future of Payments in Vietnam

The evolution arising from the Bitcoin CBDC pilot could serve as a model for other nations grappling with similar issues in rural payment systems. As other countries look to Vietnam’s advancements, the prospects for Vietnam’s economy and its emerging financial landscape could be revolutionary.

In conclusion, the Bitcoin CBDC pilot in Vietnam represents an innovative strategy to enhance rural payments, with the HIBT’s impact likely to shape the future of digital finance in the region.

As we monitor this development, the insights gained will offer invaluable lessons for global implementations of CBDC technologies.

Conclusion

As Bitcoin CBDC continues to evolve within Vietnam’s experimental framework, the ripple effects may influence other nations to rethink their payment systems. Enhanced financial inclusion through HIBT’s pioneering efforts could redefine how transactions occur in rural locations worldwide.