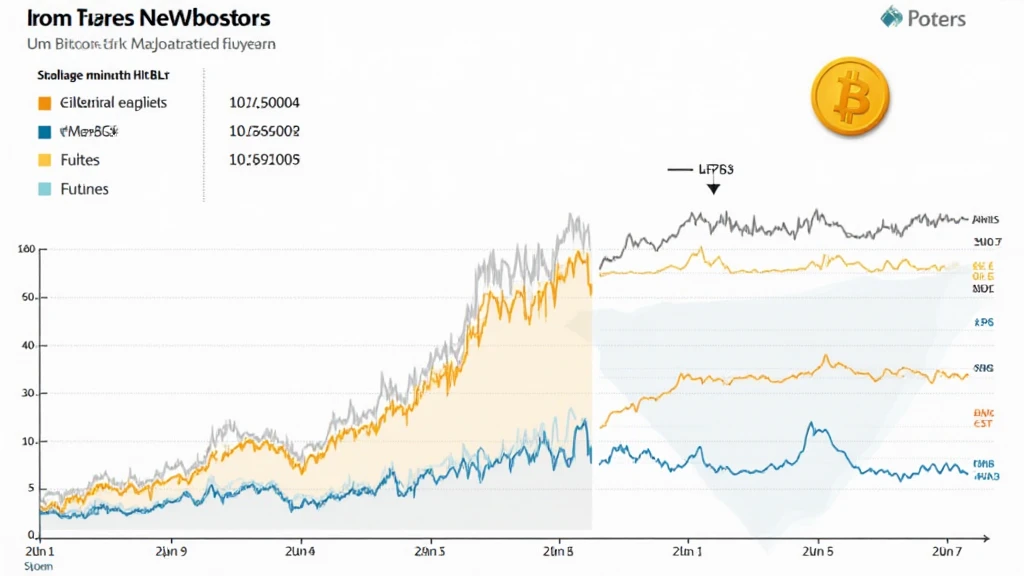

Understanding HIBT Bitcoin Futures Margin Requirements

With the crypto market witnessing unprecedented growth, many traders are exploring opportunities in Bitcoin futures. In 2024, the global Bitcoin trading volume surged to an astonishing $70 billion daily. For those interested in trading Bitcoin futures, understanding margin requirements is essential. This guide will provide an in-depth analysis of HIBT Bitcoin futures margin requirements, including the essentials for both new and experienced traders.

What are Bitcoin Futures?

Bitcoin futures are financial contracts obligating the buyer to purchase, and the seller to sell Bitcoin at a predetermined price at a specified future date. They are crucial for traders looking to speculate on the price movement of Bitcoin without owning the underlying asset. This mechanism allows traders to gain exposure while minimizing risk.

Why HIBT?

The HIBT platform stands out in its ability to provide traders with competitive margin requirements and a user-friendly interface. Compared to traditional exchanges, HIBT presents a more accessible trading environment. To navigate this effectively, understanding the various types of margin is vital.

Types of Margin in Futures Trading

- Initial Margin: This is the amount the trader must deposit to open a position.

- Maintenance Margin: This is the minimum amount to be maintained in the margin account to keep a position open.

- Variation Margin: This reflects gains or losses that must be settled in cash daily.

In the context of HIBT Bitcoin futures, the initial margin might be set at 10% of the position size, while the maintenance margin might be around 5%. These requirements are subject to change based on market volatility, making it important for traders to stay informed.

Understanding Margin Requirements on HIBT

When considering trading on HIBT, it’s crucial to understand how margin requirements work in the context of Bitcoin futures.

Example of Margin Calculation

Suppose a trader wants to buy 1 Bitcoin futures contract priced at $30,000. The initial margin required by HIBT would be:

- Initial Margin: $30,000 x 10% = $3,000

- Maintenance Margin: $30,000 x 5% = $1,500

This means the trader needs to deposit $3,000 to open the position and must maintain at least $1,500 in their account to keep the position open.

Risks Involved with Margin Trading

While trading on margin can amplify gains, it can also significantly increase risks. If the market moves against the trader’s position, they may incur losses that exceed the initial investment.

Margin Calls

A margin call occurs when the equity in the trading account falls below the maintenance margin requirement. In such scenarios, traders would be required to deposit additional funds to cover the shortfall. Failure to do so may result in the liquidation of positions, potentially at a loss.

Utilizing Leverage Wisely

One of the key benefits of trading Bitcoin futures on HIBT is the leverage it offers. Leverage can magnify both potential gains and losses.

Best Practices for Leveraged Trading

- Start with lower leverage: New traders should avoid high leverage ratios until they gain sufficient experience.

- Monitor your positions closely: The volatility of Bitcoin means prices can change rapidly.

- Use stop-loss orders: Setting stop-loss orders can help mitigate potential losses.

Emerging Trends: Bitcoin Futures in Vietnam

The Vietnamese market has shown a robust growth trend in cryptocurrency adoption, with active users increasing by 85% from 2022 to 2024. In light of this, understanding futures trading can provide Vietnamese traders with a competitive edge.

Local Market Insights

According to local reports, Bitcoin futures have gained significant traction among Vietnamese investors, as evidenced by a 40% increase in trading volume year-on-year. The robust regulatory environment and increasing financial literacy have created a fertile ground for futures trading.

Conclusion

Now that you have a deeper understanding of HIBT Bitcoin futures margin requirements, you can navigate your trading journey more effectively. As you venture into this space, remember to apply proper risk management strategies and stay updated on market dynamics.

As the crypto market continues to evolve, keeping abreast of changes in margin policies and market trends in Vietnam will empower you to make informed decisions. Let’s explore the future of crypto trading together.

For more insightful articles on trading strategies and market analysis, visit hibt.com. Always remember that trading involves risks; it’s advisable to consult local regulators and financial advisors.

With the right strategy and knowledge, you can harness the potential of HIBT Bitcoin futures for your trading endeavors.

About the Author

John Doe is a blockchain expert and cryptocurrency author with over 25 publications in reputable journals. He has led multiple audits for known projects in the industry and continues to educate traders worldwide. Connect with him for more insights.