Introduction

With over $4.1 billion lost due to DeFi hacks in 2024, understanding the intricacies of cryptocurrency trading platforms has never been more crucial. One essential element that traders should grasp is the concept of HiBT order book depth. This article seeks to provide an in-depth exploration of order book depth and its implications for traders. By the end, you’ll know how to utilize this information effectively and make informed trading decisions.

What is Order Book Depth?

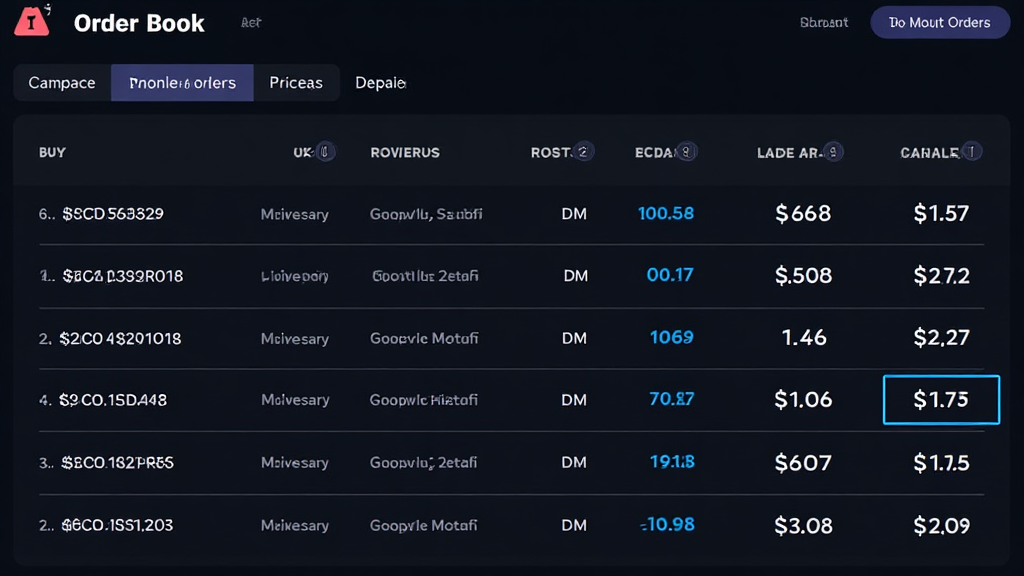

Order book depth represents the supply and demand at different price levels for a particular cryptocurrency. Think of it as a digital marketplace where buyers and sellers interact. The more orders there are at various prices, the deeper the market, indicating a higher level of liquidity.

Visualizing Order Book Depth

The order book displays lists of buy and sell orders, showing the quantity of assets available at each price level. A deep order book signifies a healthy trading environment, meaning that large trades can be conducted without significantly impacting the price. Here’s a simple representation:

| Price Level (USD) | Buy Orders (BTC) | Sell Orders (BTC) |

|---|---|---|

| 40,000 | 2.5 | 1.8 |

| 41,000 | 3.0 | 2.5 |

| 42,000 | 1.0 | 4.0 |

Data Source: HiBT

Why is Order Book Depth Important?

Order book depth plays a pivotal role in trading strategies and market behavior. Here are several reasons for its importance:

- Liquidity Assessment: A deeper order book indicates higher liquidity, which means that you can execute large trades without causing substantial price fluctuations.

- Market Sentiment: The order book provides insight into traders’ sentiment—whether they are bullish or bearish based on the buy and sell orders.

- Price Resistance Levels: Areas with significant buy orders act as support levels, while heavy sell orders tend to create resistance.

How to Analyze HiBT Order Book Depth

Analyzing the HiBT order book depth can enhance your trading strategy significantly. Here are a few methods you can use:

1. Observe Price Action

Monitor how the price behaves as large orders are executed. For instance, if a big buy order is placed, the price may rise, indicating strong demand.

2. Use Order Flow Analysis Tools

Employing order flow tools can help you visualize how the order book changes in real time. This aids in making decisions based on market fluctuations.

3. Implementing Limit Orders

By placing limit orders at specific price levels derived from order book analysis, you can benefit from better fill prices while ensuring your trading strategy is executed effectively.

4. Understanding Market Dynamics

Keep an eye on how different factors (news events, market sentiment, etc.) influence the order book. This understanding takes time, but it’s critical for navigating the volatile cryptocurrency landscape.

Vietnam’s Growing Crypto Market

Vietnam’s interest in cryptocurrency continues to rise, with a user growth rate of 27% year-over-year in 2024. As the market evolves, understanding tools like the HiBT order book depth will be crucial for both local and international traders.

According to recent surveys, approximately 22% of the Vietnamese population has engaged in cryptocurrency trading, making it one of the fastest-growing markets in Southeast Asia. The increasing participation underscores the need for reliable trading platforms that provide comprehensive order book information.

Real-World Applications of HiBT Order Book Depth

Utilizing HiBT order book depth can lead to better trading decisions in several real-world scenarios:

- Day Trading: Day traders can benefit from quick insights into market dynamics.

- Scalping Strategies: Scalers can use depth data to predict immediate price movements.

- Institutional Trading: Institutions can utilize order book analysis to minimize risk while executing large orders.

Conclusion

Understanding HiBT order book depth is more than a technicality; it’s a gateway to successful trading strategies in the fast-paced world of cryptocurrency. By analyzing the depth of order books, traders can enhance their approach and make informed decisions based on market liquidity and sentiment.

In conclusion, whether you’re a new trader or a seasoned veteran, integrating order book analysis into your strategy can provide significant advantages. The lessons drawn from this exploration demonstrate the importance of depth in creating a solid trading framework.

For more insights on navigating the cryptocurrency market, visit hibt.com.