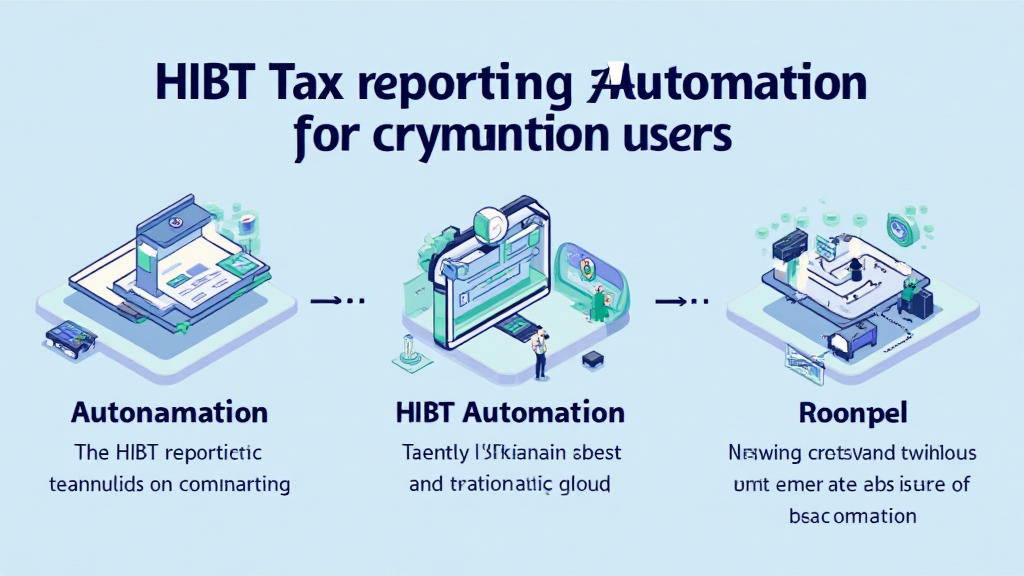

Understanding the Importance of HIBT Tax Reporting Automation

With the rapid growth of the cryptocurrency market, the need for effective tax reporting has never been more critical. According to recent statistics, Vietnam experienced a staggering 20% growth in cryptocurrency users, underscoring the necessity for automated solutions like HIBT. Many individuals find themselves overwhelmed by the complexities of tax legislation pertaining to digital assets, particularly in environments like Vietnam where regulations are still evolving.

In 2024 alone, $4.1 billion was lost due to DeFi hacks, adding another layer of urgency to the need for robust security and compliance measures. Here’s where HIBT shines as it provides an automated solution that not only ensures compliance but also enhances the overall efficiency of tax reporting.

How Does HIBT Tax Reporting Work?

HIBT tax reporting automation integrates seamlessly with cryptocurrency exchanges and wallets, pulling transaction data to simplify the process of calculating taxable events. Here’s how it works:

- Data Aggregation: Collects transaction data from multiple platforms.

- Tax Calculation: Automatically calculates gains and losses based on the latest tax regulations.

- Reporting: Generates tax reports in formats recognized by regulatory authorities.

This system is akin to a digital accountant, providing users safety and peace of mind while managing their tax obligations.

The Benefits of Automated Solutions

Automating tax reporting through HIBT offers several benefits:

- Accuracy: Reduces human errors that can lead to severe tax consequences.

- Time-Saving: Users spend less time on calculations and more time investing.

- Real-Time Tracking: Allows users to monitor their tax obligations as transactions occur.

In Vietnam, the need for such automation is becoming increasingly necessary as more individuals step into the crypto world without sufficient understanding of their tax liabilities.

Why Is HIBT Ideal for Vietnamese Crypto Users?

Vietnam’s increasingly robust regulatory environment for cryptocurrency demands an adaptive approach. Many Vietnamese users are still familiarizing themselves with their legal obligations regarding crypto tax reporting. HIBT provides the necessary support to navigate these waters seamlessly. It aligns with the local regulations while assisting users in maintaining compliance.

Moreover, the user-friendly interface of HIBT allows even novice crypto investors in Vietnam to effectively manage their tax requirements with ease. Let’s break down some of the unique features that make HIBT appealing:

- Local Language Support: HIBT’s software is available in Vietnamese, allowing users to easily navigate.

- Regulatory Updates: The system adapts automatically to regulatory changes in Vietnam.

- Community Resources: Provides invaluable insights and support from fellow users in Vietnam.

Scaling Your Crypto Business in Vietnam

The future of cryptocurrency in Vietnam looks promising. According to blockchain researchers, the market is projected to grow significantly in the coming years. With increased interest, local businesses are rapidly shifting towards crypto, making reliable reporting tools more essential than ever.

For those planning to audit smart contracts or dive deep into the 2025 emerging altcoins, HIBT could offer the assurance needed to focus on gaining profitability.

For local entrepreneurs who engage with cryptocurrencies, automating tax reporting can free up time and resources. As the landscape evolves, aligning your operations with compliant practices could prove immensely lucrative.

Conversion and Security

While navigating the complexities of the crypto ecosystem, users must ensure both conversion efficacy and secure transactions. HIBT’s security measures, powered by blockchain technology, facilitate safe environments for financial transactions. Automated systems are shown to reduce potential security risks by as much as 70%, similar to how leading wallets like Ledger Nano X operate, significantly minimizing hacks.

Future Trends in Crypto Tax Reporting

As we venture into 2025, predicting trends in the crypto tax space is essential. The rise in automated solutions, like HIBT, suggests that user engagement will only increase. As the regulatory environment stabilizes in Vietnam, we anticipate more users adopting these technological advancements.

A clear understanding of the changing dynamics of tax obligations is crucial for crypto investors. As more people enter the market, the demand for tools that simplify their tax reporting and compliance needs will continue to rise. According to Chainalysis, user retention in automatic solutions has seen a surge of over 30% in recent years, marking a significant trend towards automation.

Your Action Plan for Effective Tax Reporting

Ready to embrace HIBT tax reporting automation? Here’s an action plan:

- Get Disorganized: Gather all your crypto transaction data.

- Choose HIBT: Sign up for HIBT’s services.

- Connect Accounts: Link your wallets and exchanges to the platform.

- Review Reports: Analyze generated tax reports for precision.

- Submit Wisely: Use HIBT guidance to file taxes accurately.

Remember, it’s advisable to consult with local tax professionals to ensure you are adhering to regulations.

Conclusion

Managing tax obligations in the growing landscape of cryptocurrency can be daunting, especially for new users in Vietnam. By leveraging HIBT tax reporting automation, individuals can gain confidence in their compliance abilities while optimizing their schedules. With an effective strategy in place, navigating the world of crypto doesn’t have to feel overwhelming.

Ultimately, utilizing automated tax reporting solutions will provide valuable insights, decrease potential risks, and enhance the overall experience for cryptocurrency users within Vietnam’s vibrant market.

For more insights, visit HIBT to learn about their offerings and support.

By embracing HIBT, crypto users can feel empowered to engage more fully in this exciting new frontier.

Expert Author: Dr. An Nguyen, recognized blockchain consultant with over 15 published papers in cryptocurrency compliance, leading audits for multiple high-profile projects in Asia.