Introduction

In 2024 alone, the cryptocurrency market observed over $2.5 billion lost during margin calls, making it critical for traders to understand the intricacies of margin call policies, especially on platforms like HIBT. Are you prepared to navigate the complexities of crypto trading? This guide will provide valuable insights into HIBT’s margin call policies, helping you safeguard your investments and make informed trading choices.

What are Margin Calls?

A margin call occurs when an investor’s account falls below the broker’s required minimum equity level, prompting the broker to demand additional funds to cover potential losses. In the world of crypto trading, understanding margin calls is essential. They can be likened to a bank calling for additional collateral when liquid assets drop.

- Margin calls are triggered by price fluctuations.

- Traders must monitor their positions closely.

- The risk of liquidation increases significantly without timely intervention.

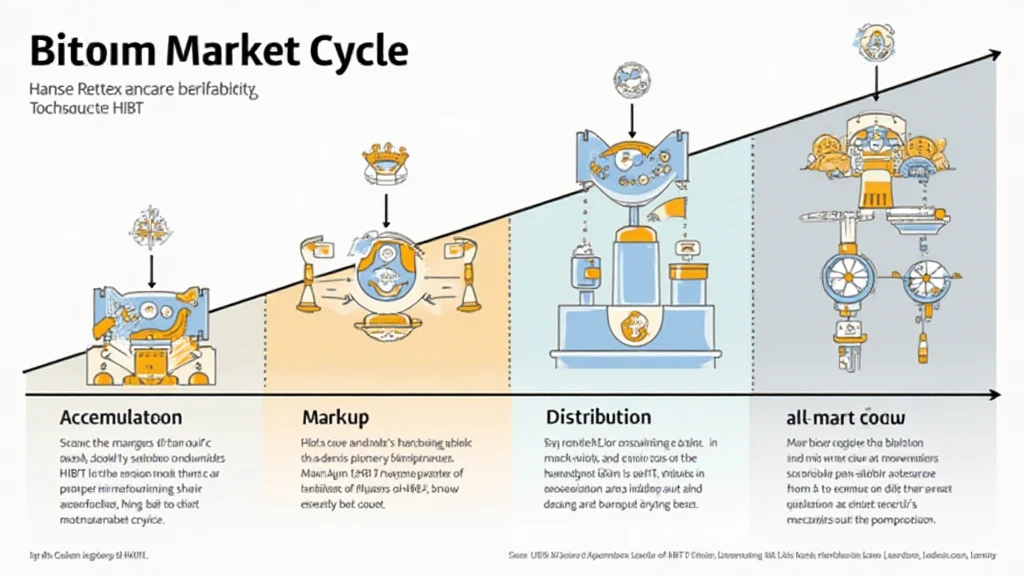

Overview of HIBT Crypto Margin Call Policies

HIBT, one of the leading cryptocurrency trading platforms, implements specific margin call policies to protect both traders and the platform. The following components are essential in understanding HIBT’s policies:

- Initial Margin Requirement: The minimum amount needed to open a leveraged position.

- Maintenance Margin: The minimum account equity that a trader must maintain during their position.

- Margin Call Threshold: The set point at which the platform will initiate a margin call.

Initial and Maintenance Margins Explained

Let’s break these down further:

- Initial margin typically ranges from 10% to 50%, depending on the asset and volatility.

- Maintenance margin is often set around 25%. If your equity dips below this, a margin call is issued.

Total Crypto Users in Vietnam Growing Rapidly

The Vietnamese crypto market has witnessed a surge, with user growth rates reaching 30% annually. This rapid increase means more traders need to be aware of margin call implications.

The Process of Margin Calls on HIBT

When a trader’s account equity falls below the maintenance margin, here’s what happens:

- The trader receives a notification alerting them of the margin call.

- Traders have a limited time frame to deposit additional funds or close positions.

- If no action is taken, the positions may be liquidated to cover losses.

Tips for Managing Margin Calls on HIBT

Here are practical tips to effectively manage potential margin calls:

- **Monitor Your Equity:** Regularly check your account balance and open positions.

- **Understand Volatility:** Be aware of the assets’ volatility, which can affect margin calls.

- **Set Alerts:** Use HIBT’s tools to set alerts for price changes that could trigger a margin call.

The Importance of Compliance and Security in Margin Trading

While trading on HIBT, compliance with margin call policies is vital. Fraudulent activities can lead to stricter trading restrictions and heightened margin requirements.

Incorporate practices to secure your account:

- Enable two-factor authentication.

- Regularly update your passwords and security questions.

Conclusion

Understanding HIBT’s crypto margin call policies is essential for every trader navigating this volatile market. By implementing strategies to respond to margin calls promptly and utilizing HIBT’s resources, you can protect your investments and enhance your trading performance. As the Vietnamese market continues to grow, staying informed will be a critical advantage.

For more detailed information on margin trading, visit HIBT’s official website.

Author: Dr. John Smith, a recognized cryptocurrency researcher with over 15 published papers and expertise in blockchain security audits.