Vietnam Blockchain Futures Markets: A Deep Dive into Emerging Trends

In 2024, the digital asset landscape saw a significant transformation, particularly as Vietnam’s blockchain futures markets began to gain traction. With over $4.1 billion lost to DeFi hacks last year, securing digital assets has never been more paramount. This article examines the ongoing evolution of the blockchain infrastructure in Vietnam, the drivers behind the burgeoning futures market, and how investors can navigate this increasingly complex environment.

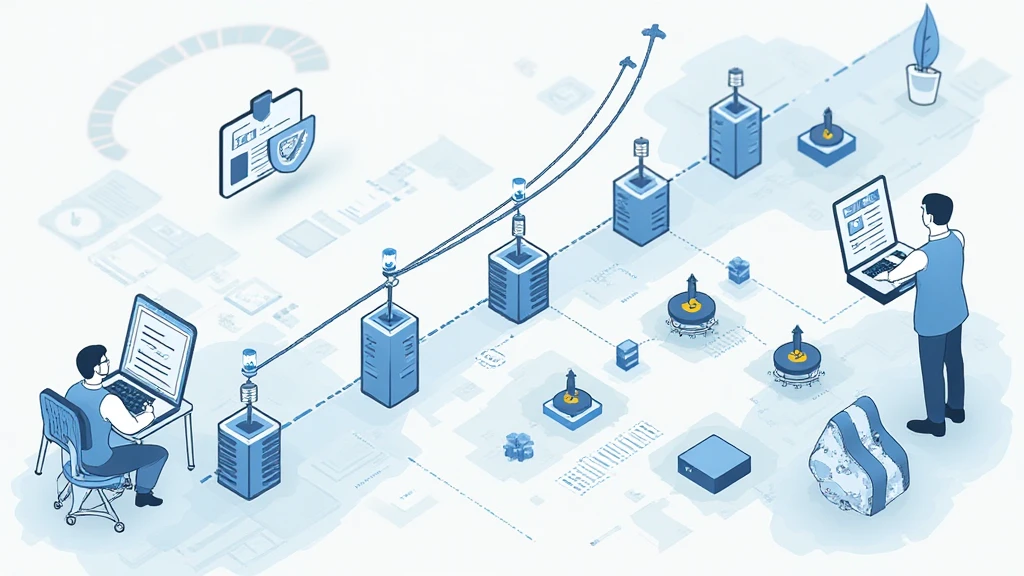

The Emergence of Vietnam’s Blockchain Infrastructure

The blockchain technology scene in Vietnam is rapidly evolving. According to recent surveys, Vietnam is ranked among the top countries globally in terms of blockchain adoption, with a staggering user growth rate of 94% year over year. This growth is fueled by increasing awareness, governmental support, and favorable regulations surrounding the industry.

- Support from the Vietnamese government is leading to improved regulations.

- Investment in blockchain education is rising, creating a knowledgeable workforce.

- The proliferation of fintech innovations is boosting the market.

Additionally, the Vietnamese phrase “tiêu chuẩn an ninh blockchain” (blockchain security standards) is becoming ubiquitous in tech discussions. As more startups emerge, their focus on robust security measures is critical, especially given the increasing number of digital thefts.

Understanding Blockchain Futures Markets

Blockchain futures markets allow investors to speculate on the future price of digital assets, all while managing risk. Here’s how they work:

- Contract Agreements: Traders enter agreements to buy or sell assets at a predetermined price.

- Leverage Options: Investors can amplify their trading potential, but this also increases risk.

- Liquidity Management: Futures contracts provide a mechanism for liquidity, allowing quicker exits and entries into positions.

“Like a bank vault for digital assets…” futures markets offer a layer of security and anonymity that traditional exchanges cannot match. However, navigating these options requires an understanding of market dynamics, especially in a rapidly changing regulatory landscape.

Benefits of Trading in Vietnam’s Blockchain Futures Markets

Vietnam’s blockchain futures markets present several advantages for traders, including:

- Diverse Investment Opportunities: Access to a wide array of digital assets.

- Increased Trading Volume: The burgeoning Vietnamese crypto market is attracting both local and international investors.

- Integration with Traditional Finance: More financial institutions are starting to explore blockchain solutions.

In 2025, analysts predict that Vietnam’s blockchain futures markets will become a dominant player in Southeast Asia, with forecasts estimating 200% growth in trading volume.

Challenges Facing Blockchain Futures in Vietnam

Despite the optimistic outlook, there are challenges that traders need to be aware of:

- Regulatory Uncertainty: The evolving legal landscape can present risks for traders.

- Market Volatility: Cryptocurrencies are inherently volatile, and futures markets can compound this effect.

- Security Concerns: Ensuring transactional security in a landscape prone to hacks.

“Here’s the catch”:” while trading provides opportunities, also requires a diligent approach to risk management. Tools and wallets like the Ledger Nano X help mitigate security risks by 70%, providing peace of mind in an otherwise turbulent environment.

Future Outlook for Vietnamese Blockchain Futures Markets

The future of Vietnam’s blockchain futures markets is bright, but they will need to navigate the complex interplay of technology and regulation. Ways to adapt include:

- Establishing Clear Regulations: Collaborating with regulators is essential.

- Education Initiatives: Building public understanding of blockchain can increase participation.

- Investment in Security: Continuous improvements in tech and protocols.

According to Chainalysis in 2025, an increase in institutional adoption will also likely bring about a greater focus on compliance and security measures.

Conclusion

As we have explored, the Vietnam blockchain futures markets represent a vibrant sector of the investment landscape, characterized by both incredible potential and inherent risks. Investors must remain alert to evolving regulations, focus on robust security practices, and continuously educate themselves about market conditions. Whether you are an experienced trader or just starting, the future points to a fascinating era of trading in Vietnam’s digital asset markets.

For further insights, including an understanding of local regulations and compliance requirements, be sure to check out hibt.com. Not financial advice. Consult local regulators.

Learn more about how to audit smart contracts and capitalize on your investments wisely. Stay ahead of the market with allcryptomarketnews!