Introduction

Amidst the rapid growth of cryptocurrency, Vietnam’s regulatory landscape is evolving. In 2023, the country observed a 40% increase in crypto transactions. However, this surge brings challenges, particularly in tax compliance. With the rising losses—over $4.1 billion due to various crypto-related issues—Vietnamese investors need reliable tools. This is where Vietnam crypto tax software comes into play, offering diverse features tailored to meet the local requirements.

Understanding the Need for Vietnam Crypto Tax Software

As digital assets gain traction, understanding local laws is critical. According to the Ministry of Finance, Vietnam aims to enforce regulations that promote transparency and security in the blockchain domain. This includes ensuring compliance through effective tax reporting mechanisms.

Key Features to Look for in a Tax Software

- Comprehensive Reporting: The software should facilitate thorough reporting, covering various asset classes.

- User-friendly Interface: A straightforward dashboard that simplifies navigation and understanding.

- Automated Calculations: Minimizing manual errors with real-time calculations—especially crucial in a volatile crypto market.

Automation in Tax Reporting

Think of crypto tax software as your personal accountant, where automation saves you time and effort. It pulls data from your trading history and automatically calculates the capital gains or losses, streamlining the entire process.

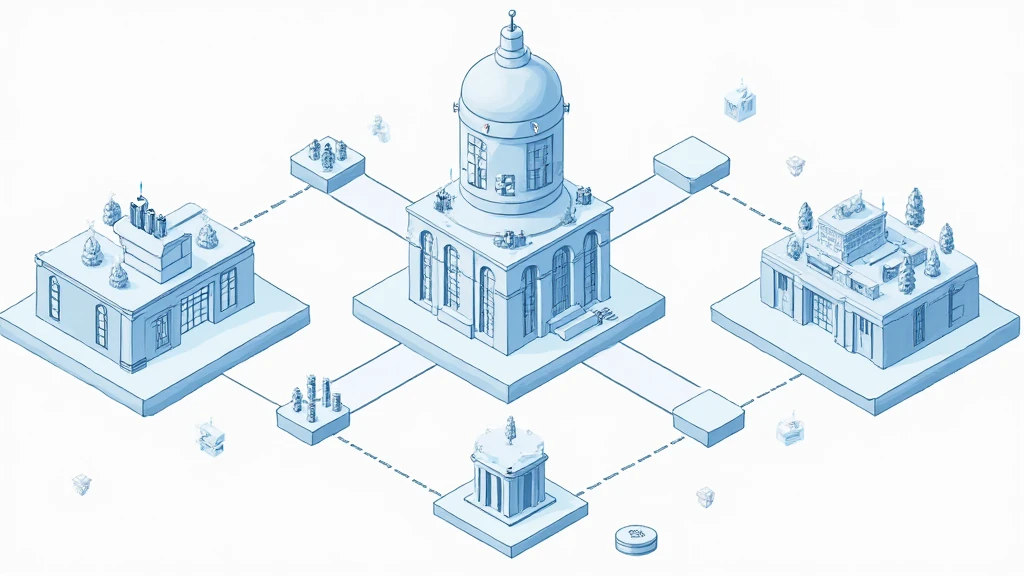

Incorporating Blockchain Security Standards

Software that adheres to tiêu chuẩn an ninh blockchain will ensure that your data is safe. Tools that integrate with secure wallets, like Ledger Nano X, further bolster security, reducing risks by 70%.

Local Market Adaptation

The Vietnamese market presents unique challenges. Recent statistics highlight that there are approximately 3 million active crypto users in Vietnam. Therefore, tax solutions must be tailored. Look for software that understands local regulations deeply and can provide insights specific to the Vietnamese context.

Real-world Application Scenarios

- Freelancers: Cryptocurrency payments can complicate income declarations. A robust tax tool can simplify this.

- Investors: Investors with multiple crypto transactions will benefit from tracking and calculating their returns seamlessly.

- Businesses: Companies accepting crypto need swift, accurate ways to handle transactions and report taxes accordingly.

Choosing the Best Software for You

Here’s the catch: not all software is created equal. When selecting a crypto tax solution in Vietnam, consider factors like customer support, ease of integration with your existing financial practices, and whether it offers educational resources for new users.

Review and Validate

Before making a purchase, review different software. Check for user testimonials, success stories, and coverage of external audits or certifications from industry experts to ensure reliability.

Conclusion

In conclusion, Vietnam crypto tax software is not just a luxury; it’s a necessity for investors and businesses alike. As the country navigates through the complexities of digital asset management, having reliable tax solutions is paramount. With the right features and local adaptation, these tools not only simplify tax reporting but also enhance compliance and security. Stay ahead of the game and leverage Vietnam crypto tax software to ensure smooth sailing through the complex waters of cryptocurrency taxation.

Author: Dr. Nguyễn Văn Anh

A recognized blockchain expert, Dr. Anh has published over 20 papers in the field and has led audits for notable projects such as Blockchain for Supply Chain.