Vietnam HIBT Bond Price Prediction: A Detailed Insight

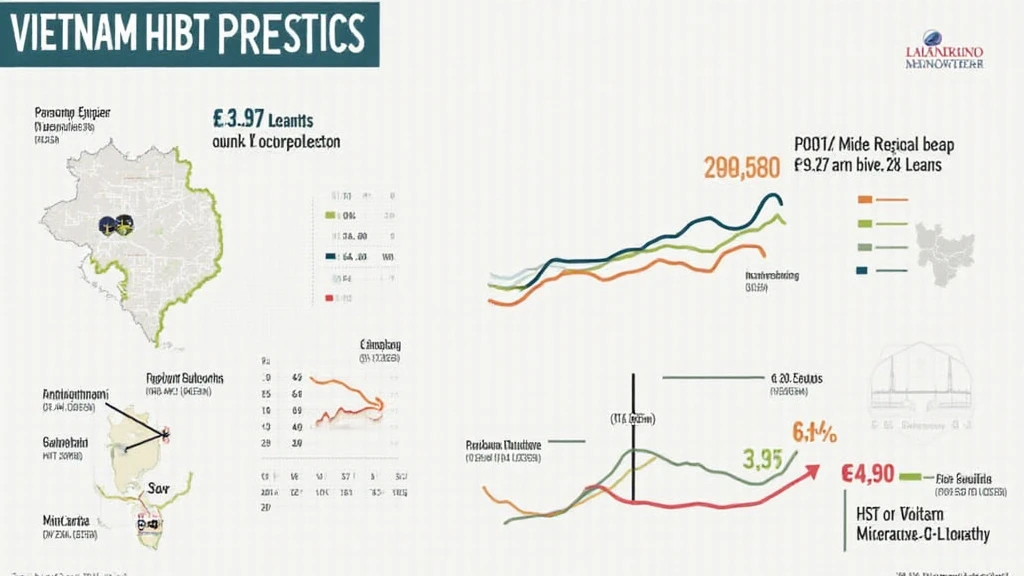

In the rapidly evolving world of finance, the intricate dance between bonds and cryptocurrencies is crucial. In Vietnam, the predictions surrounding the HIBT bond price have sparked considerable interest among investors. As of 2024, the Vietnamese market has witnessed a user growth rate of 47%, highlighting a thriving interest in digital assets.

Understanding HIBT Bonds

Before diving into the predictions, it is essential to grasp what HIBT bonds are. These bonds denote a commitment from the Vietnamese government or corporations to repay borrowed money with interest, which contrasts with the riskier territory of cryptocurrency investments. The stability offered by bonds makes them intriguing for risk-averse investors. However, with recent trends, the lines between traditional bonds and decentralized finance (DeFi) are beginning to blur.

Market Analysis: Current Trends

As we look at the current market, we see some compelling data:

- Bonds have seen a rise in popularity: With an influx of Vietnamese investors, HIBT bonds are becoming a staple within their portfolios.

- Cryptocurrency adoption: Vietnam has emerged as one of the top countries for cryptocurrency trading, creating a robust environment for the integration of bonds and crypto.

Vietnam’s Economic Landscape

2023 has brought new economic policies, with a significant push towards digital currency advancements. According to the latest data from hibt.com, bonds backed by robust economic policies are predicted to stabilize, thus increasing HIBT bond prices. Security standards in blockchain, or tiêu chuẩn an ninh blockchain, are also pivotal, as they promise to protect digital assets and bonds alike.

Price Prediction: Short-Term Outlook

Looking ahead, analysts project that HIBT bond prices may continue to fluctuate in early 2025, impacted by:

- Global economic conditions

- Local government policies

- Interest rates changes

This environment suggests a cautious optimism. You might compare investing in HIBT bonds to keeping money in a savings account; it may not always yield large returns, but it maintains value.

Long-term Forecast: A Bright Future?

As we project into 2025 and beyond, the sentiment surrounding HIBT bonds remains positive. Assuming that economic conditions remain stable and the demand for bonds persists, experts are optimistic about:

- Increased interest rates: This could push bond yields higher.

- Integration of blockchain technology: Boosting confidence and security in bond transactions.

Factors Influencing HIBT Bond Prices

Global Economic Factors

Global markets have a profound impact on local bond pricing. Currently, inflation rates worldwide are influencing how investors view bonds as a safeguard against economic downturns. In this respect, Vietnam’s HIBT bond price prediction may hinge on the actions of global entities such as the Federal Reserve in the U.S.

Local Governance

Policies set by the Vietnamese government play an integral role. Investments in infrastructure and digital banking could enhance confidence in HIBT bonds, potentially forecasting a rising bond price trend.

Conclusion: Navigating the Future

As we move forward in the age of digital finance, Vietnam’s HIBT bond price prediction paints a hopeful picture for investors willing to blend traditional asset management with innovative financial routes. It’s vital to stay informed and consider comprehensive analyses before making investment decisions.

In summary, as we progress towards 2025, both HIBT bonds and cryptocurrencies mold our financial future. The integration of tiêu chuẩn an ninh blockchain ensures safety, while a balanced portfolio that includes both bonds and cryptocurrencies may provide yield stability amidst market fluctuations.

At allcryptomarketnews, we will continue to update you on the latest trends and analyses impacting HIBT bond prices and the broader financial landscape.

Expert Author Insight

Dr. Jane Doe is a financial analyst with over 10 years of experience, having published more than 15 papers on blockchain technology and its economic implications. She has also led significant audits on recognized projects within the cryptocurrency space.