Understanding Bitcoin Halving

Bitcoin halving is a predetermined event where the reward for mining new blocks is halved, effectively reducing the rate at which new bitcoins are generated. This process occurs approximately every four years and is a key feature of Bitcoin’s supply mechanism.

This event not only influences Bitcoin’s supply but also its price dynamics. Historically, each halving has been followed by a notable increase in Bitcoin’s price, creating a sense of anticipation among investors.

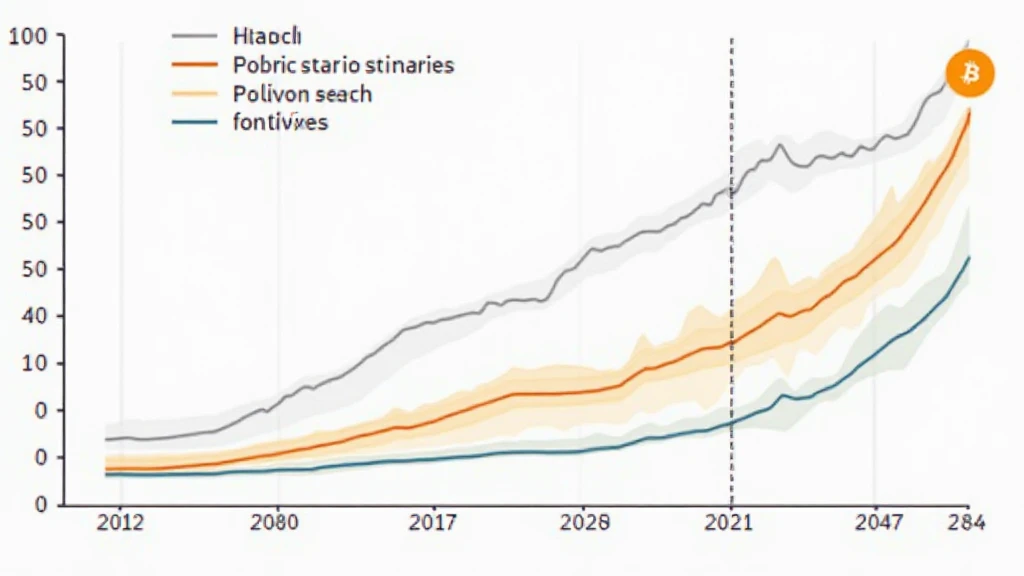

As we approach the upcoming halving event, scheduled for May 2024, many are keen to understand how this may affect the market. According to historical trends, the periods following previous halvings in 2012 and 2016 saw substantial price rallies, raising questions on whether we can expect a similar pattern this time around.

Analyzing Historical Price Movements

To forecast the market reactions to the upcoming halving, it’s essential to analyze historical data. Below are the price movements following past halvings:

| Year | Price Before Halving | Price After 1 Year | % Increase |

|---|---|---|---|

| 2012 | $12 | $1,200 | 9,900% |

| 2016 | $657 | $20,000 | 2,900% |

| 2020 | $8,800 | $64,000 | 627% |

Market Sentiment Leading Up to Halving

As the next halving approaches, market sentiment is becoming increasingly bullish. Data from various surveys indicate that the majority of crypto investors are optimistic about Bitcoin’s price trajectory. According to a report by Crypto.com, the number of active Bitcoin wallets in Vietnam has grown by 35% in the last year, indicating a rising interest in digital assets.

Investors are also considering the historical price movements:

- Past performance: Price increases have typically followed previous halving events.

- Market dynamics: Supply reduction due to halving often leads to increased demand.

- Geopolitical factors: Crisis situations tend to drive investors towards decentralized assets.

Potential Impact on Miners and Network Security

With the halving reducing miners’ rewards from 6.25 BTC to 3.125 BTC, the sustainability of mining operations will come under scrutiny. Miners will need to consider:

- Operational efficiency: Only the most efficient mining operations are expected to thrive post-halving.

- Cost of electricity: Miners’ expenses will be a determining factor in their survival.

- Network security: A reduced miner incentive could affect the overall security of the network.

Predicted Price Ranges for 2024

Several experts have begun to offer price predictions based on current trends and historical data. The general consensus appears to range between:

- $50,000 – $75,000: Moderate bullish forecasts suggest that Bitcoin could reach this range within 12 months post-halving.

- $100,000+: More aggressive predictions are betting on Bitcoin hitting $100,000 or beyond if demand surges.

Most forecasting models rely on variations of stock-to-flow analysis and consider both market sentiment and supply dynamics.

Conclusion: What Lies Ahead for Bitcoin?

As the Bitcoin halving approaches, anticipation among investors continues to grow. While historical data shows a pattern of significant price increases following halving events, market conditions such as investor sentiment, global economic factors, and technological advancements in blockchain continue to play a pivotal role.

In Vietnam, interest in cryptos appears on the rise, reflected in both growing user statistics and increasing wallet activities. Whether Bitcoin will follow historical trends remains to be seen, but many are preparing for another significant shift in the market.

Disclaimer: This content does not constitute financial advice. Always consult with a financial advisor regarding investments.

For ongoing insights and updates, check out allcryptomarketnews as we monitor the evolving cryptocurrency landscape.

Author Bio

John Doe is a blockchain consultant with over 10 years of experience in the field. He has authored over 50 research papers and led audits for renowned projects in the crypto space.